Meet Augmented Underwriting.

To enrich risk selection and pricing, this solution combines our award-winning underwriting platforms with machine learning, AI and data assets to give you unrivalled intelligence and processing for your portfolio.

Watch: What is Augmented Underwriting?

Watch: Why choose Augmented Underwriting?

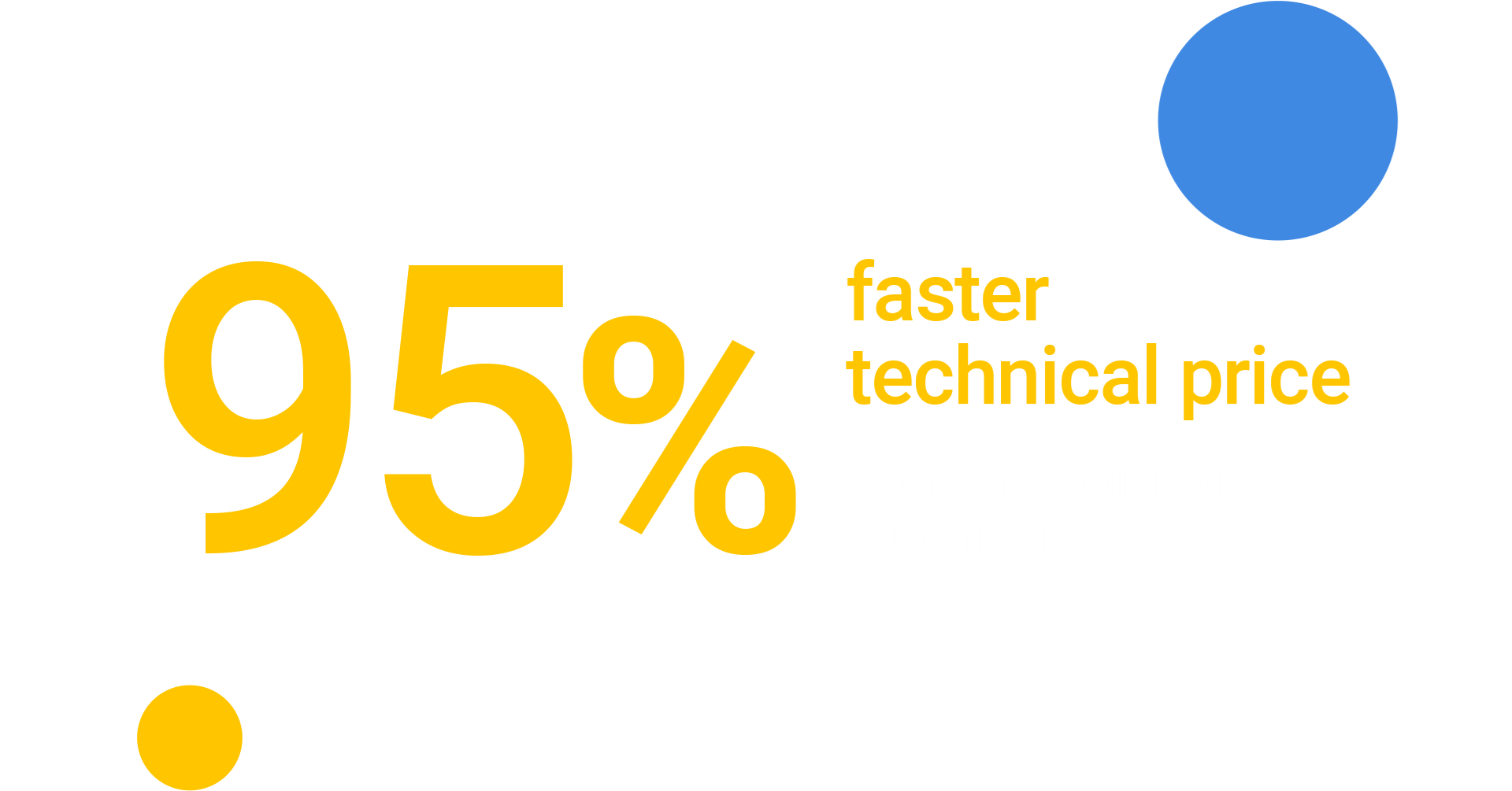

From submission to augmentation to the underwriter's desk in minutes, not days.

Case Study: Better, Quicker Risk Pricing with Avatar

Augmented Underwriting is set to shake up the insurance market, learn more about how Verisk is transforming Avatar’s underwriting process, by creating an end-to-end platform to underwrite US property risks. Their bespoke Augmented Underwriting Solution also helps Underwriters overcome day-to-day challenges and common problems.

How it works

- Underlying risk data is enhanced using Verisk property and peril data

- Individual locations and policies are scored and normalised to provide a comparable view of risk

- Verisk's best-in-class CAT modelling through Touchstone can be enabled to provide fast additional probabilistic view of risk and improved capacity deployment

- Submitted data alongside enhanced data is loaded into a Data Warehouse

- Dashboards are configured to provided clarity on potential profitability, effort to analyse, and previous modelled results and scores

- Armed with multiple angles on the submission and its underlying asset base, the underwriter has a holistic view of the risk and its potential performance.

Benefits to you

- Trading efficiency – Underwriters can spend their time on the business that matters most, rather than trying to cope with volume

- Customer experience – improved speed to decision to service the end client

- Optimised capacity – real-time risk assessment against portfolio performance

- Talent retention – newcomers to the insurance market want to trade in a digital way and expect to use technology, the way we live our lives outside of work

- Improved results – quote-ready data on Underwriter screens with a more comprehensive view of risk impact on overall portfolio and capital efficiency

- Leading the pack – get ahead of your peers. First to market with a comprehensive response means more business